- Details

- Hits: 5888

Investment Management

To develop an effective investment portfolio, a skilled Lantern Wealth Advisor will take into account your personal financial objectives which are based on your time horizon, risk tolerance, age, and other circumstances unique to you. We do not take a “cookie cutter” approach to your investments, and do not apply a one-size-fits-all methodology to managing your assets.

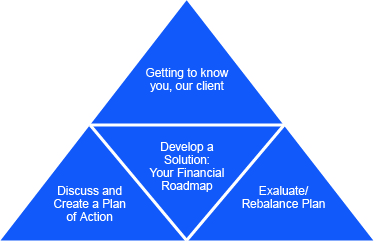

A correctly designed investment plan can mean the difference between struggling to have enough money to live a financially comfortable lifestyle, especially as you move toward retirement. Our investment management process utilizes a disciplined, yet personal, four-step method implemented by your Lantern wealth advisor that are shown below:

After you and your advisor have a comprehensive interview about your goals, a detailed questionnaire is completed and the initial plan of action incorporating your goals and your risk tolerance is created. This is your initial financial roadmap. At that point, we evaluate the best investment management and risk strategies to implement for you.

Steps in Our Investment Process

Our investment process includes the following:

- Assessment of goals, objectives and risk tolerance

- Creation of an Investment Policy Statement (your blueprint)

- Ongoing review of the Investment Policy Statements

- Determining the asset allocation model, and portfolio structuring

- Third-party investment firm analysis and selection

- Ongoing risk management, attribution and performance reporting

As we go through the above steps in our investment process, we keep you apprised of every step along the way. We want you to understand the “why” behind our decisions, so we provide ongoing education and information to you. We follow your investment “blueprint” (technically called the Investment Policy Statement) to ensure we are on track. But, importantly, as you transition through certain life events, we keep in mind that asset allocations may change to keep them in alignment with your goals. These life transitions may be events such as marriage, divorce, children in college, inheritance, change of career/job, business expansion or closure, disability, death and other personal or professional occurrences. We have a “partnership” with our clients and that partnership also transitions with them through good times as well as challenging times.